All Categories

Featured

If you're going to use a small-cap index like the Russell 2000, you could wish to stop and consider why an excellent index fund company, like Lead, doesn't have any kind of funds that follow it. The reason is due to the fact that it's a lousy index.

I have not also attended to the straw male here yet, which is the truth that it is relatively uncommon that you actually need to pay either taxes or substantial commissions to rebalance anyway. I never have. A lot of smart capitalists rebalance as much as possible in their tax-protected accounts. If that isn't fairly sufficient, very early accumulators can rebalance totally utilizing new payments.

No Lapse Universal Life

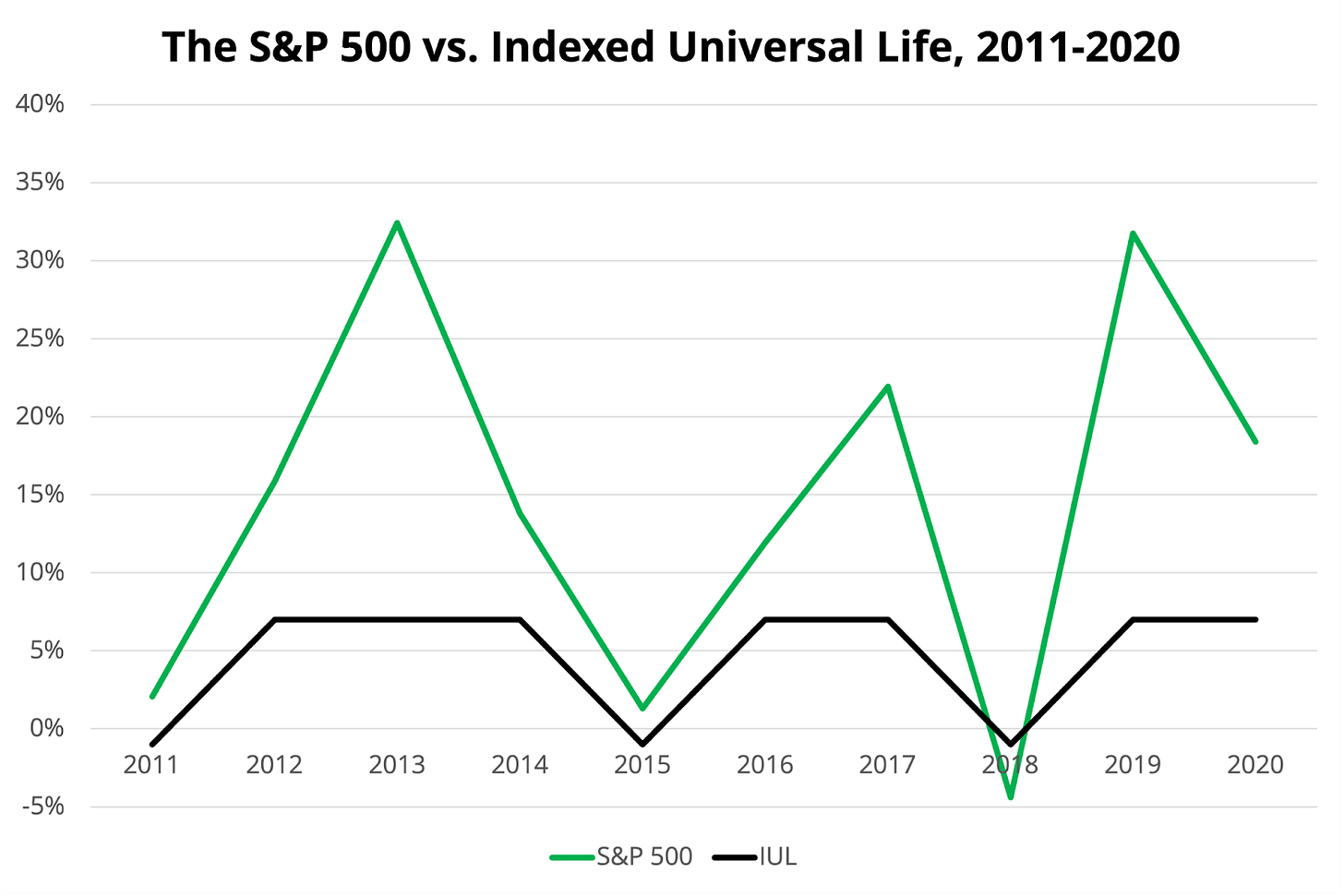

Decumulators can do it by taking out from possession classes that have done well. And obviously, no one should be buying loaded shared funds, ever. Well, I hope messages like these assistance you to see via the sales methods typically used by "financial specialists." It's truly too negative that IULs don't work.

Latest Posts

Indexed Universal Life Unleashed

Iul Investment Calculator

Index Universal Life Insurance Reviews